BITCOIN LOANS WITHOUT VERIFICATION NOR COLLATERAL

Bitcoin is the center of a growing loan industry. Bitcoin is a great collateral because it is a highly liquid and global market. The keys to Bitcoin are controlled by the person who holds them. It is easy to use Bitcoin as collateral. You don’t need to have a good credit rating or be creditworthy. Bitcoin can help you build your reputation. Independently, lenders build their reputation. It is very difficult to borrow cryptocurrency without collateral.

Bitcoin loans are not available without collateral, verification or free loans. Do not fall for crypto-scammers.

How to get a Bitcoin loan without collateral

You don’t have to have a good credit record to apply for a Bitcoin loan. You can apply for a Bitcoin loan without having to have a credit history. It is crucial to thoroughly check the terms of any loan you are considering before applying.

Also, ensure that you have all necessary documentation to build your reputation. A good reputation is a way to get a loan at a lower rate. A video verification may be required to access a loan.

After you have submitted all documentation, it is time to start building your Bitcoin reputation. You can build your reputation by keeping in touch with lenders and answering their questions. You can convert Bitcoin to fiat money once you have received the loan.

Read about: South Africa to launch cryptocurrency guidelines in 2022

Instant Bitcoin Loan with No Collateral

Do you want to be a borrower who needs an immediate loan? Or are you a lender looking for an opportunity to earn interest? Peer to peer lending platforms make it possible to lend or get a Bitcoin loan instantly. It works with digital currencies like Bitcoin and Ethereum. The loan market is open to both the borrower as well as the lender. Online peer-to-peer lending platforms are the best way to obtain a Btcoin loan immediately or to lend.

Bitcoin loan without collateral

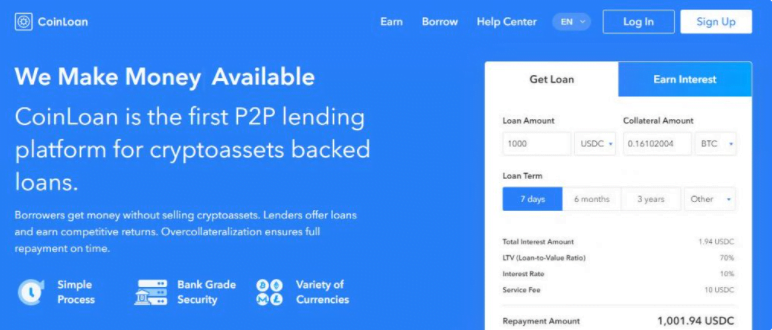

How to get a Bitcoin loan instantly with CoinLoan

It is easy to get a Bitcoin loan in an instant. You repay the loan with interest over a set period, plus some fees. Some lenders require that you repay the loan in installments, while others require that you repay it in one lump sum.

An account is required to use the lending platform. Before you can borrow, you will need to verify your information. Next, enter the amount you want to borrow, the term of the loan, and the interest rate. If a lender is available to lend on the terms you have specified, the process will be completed immediately. If this does not occur, the borrower will have to wait until offers are received so that he can examine them and then choose the best offer to receive Bitcoin.

If you don’t want to negotiate, you may be able to get a peer-to-peer Bitcoin loan instantly with BTCPOP. These loans are private so you can do whatever you like with them, unlike traditional loans that require you to make a claim. They are also not based on your credit score, but your reputation.

Bitcoin Loan without Verification or Collateral

Bitcoin loans without verification, Bitcoin loans without deposit or free Bitcoin loans are not available. There are also no crypto loans that require collateral. Do not fall for scammers promising you a loan with no collateral. The reality is that Bitcoin is profitable and some lenders are able to offer loans at low interest rates using your Bitcoin as collateral. Some lenders offer instant, quick Bitcoin loans and others provide micro loans in Bitcoin. You get a loan in fiat currency, and the lending platform retains your Bitcoin as collateral. A high-value cryptocurrency can be used as collateral to get a loan in crypto.

What happens if you have Bitcoin but need to borrow fiat currency? We’ll show you. It’s easy. It is easy. Next, find a lender that will accept your Bitcoin as collateral and offer you a fiat currency equivalent loan. You may need to verify your identity with some platforms. This may involve a video chat with an agent. You can then get a loan tailored to your needs. You don’t lose your digital assets if your Bitcoin appreciates in the future.

How to get a Bitcoin loan

You will need to provide cryptocurrency, such as Bitcoin, as collateral in order to get a loan crypto with these platforms. There are no credit checks like bank loans. Credit score is not an indicator of creditworthiness. Many people can borrow Bitcoin immediately even if they aren’t able to get loans from traditional financial institutions.

Best Bitcoin Loan Sites

Getline

Getline was a Bitcoin lending company that provided low-interest loans to customers. The signup process was simple and the website informative. However, it is no longer operational. To sign up, you only needed an email address and a password. A line of credit could be obtained with a fee structure of 30% for the lender. It charged 0-1 percent per day depending on which lender you used. Getline was slow to respond and its system was unstable, which may have been why it ended up being inactive. The fees paid by lenders were high, and there were restrictions in certain countries.

Nebeus Crypto Loans

Nebeus, a UK/Spain-based company that deals in online lending, is called Nebeus. It also offers other crypto services like trading, crypto renting, and remittances. Flexible Loan Plan: Cryptocurrency holders are eligible for an instant cash loan up to 80% of the value of their Bitcoin. Your crypto portfolio can be used as collateral for a fiat-money loan. You will need 0.045818 Bitcoin to secure a $1000 loan. You will be responsible for $1,026 monthly, if your repayment period is six months. If the loans are paid off within 30 days, there are no fees for early repayment.

A minimum loan of 0.005 Bitcoin is allowed. The maximum amount borrowed depends on the borrower’s credit rating. Nebeus doesn’t have an approval process and issues loans immediately. In minutes, you can transfer a loan from any credit card or debit card to EUR, USD or GBP. This is a list of Nebeus cryptocurrency loans that are supported bys.

Two types of loans are available from Nebeus: Flexible Loans and Quick Loans.

Nebeus Quick Loans

- Rate of interest: 0%

- Cash: From 50 to 500EUR

- Term: 3 Months

- Loan Origination Fee: 2.5%

- Early repayments are free

Nebeus Flexible Loans

- Rate of interest: 6% to 13.5%

- LTV: From 50% to 80% of Crypto value

- Term: Maximum 3 Years

- Loan Origination Fee: 0%

- Maximum Loan Limit: 250,000 euros

- Early payment fee (before 30 days) 2.5%

CoinRabbit Crypto Loans

CoinRabbit offers crypto-backed loans and savings accounts. The platform offers loans at 14% APR and deposits at 10% APY. CoinRabbit offers crypto loans anonymously and don’t require KYC. The entire process takes around 10-15 minutes. According to the company, it is the first on the market that supports DOGE, DGB and NANO coins, as well as FIRO.

CoinRabbit loans can be repaid at any time. Clients have the option to increase their collateral or repay the loan in full or part at any time. For loans lasting more than 30 days, CoinRabbit charges are zero. Otherwise, 100$ worth of selected stablecoins is charged.

The maximum loan limit at the moment is dependent on the coin. For BTC, the maximum loan amount is 1,000,000 and 10,000 respectively. All collaterals have a minimum loan amount of 100 USDT.

Nexo Crypto Loans

Nexo is a cryptocurrency exchange and instant crypto lending platform. It was founded in 2017. The platform allows the borrower to deposit crypto assets into his wallet, and then receive instant credit. To borrow $1000, for example, you will need 0.0479 bitcoin as collateral. The money can be spent with a Nexo debit card, or it can be withdrawn to your bank account. Nexo offers over 40 fiat money currencies and is available in more than 200 countries.

Nexo was the first platform to offer instant crypto lending. BTC, BCH and BNB can be used as collateral. Once the loan-to value ratio has been established, you will receive money in fiat or stablecoin. Repay the loan in Nexo tokens to get a 50% discount on your interest loan. The interest rate for these loans is 5.9% APR. Borrow up to $50 million.

BlockFi Crypto Loans

BlockFi was established in June 2017 in New Jersey. BlockFi’s bitcoin loan app allows you to apply for an immediate loan. The platform allows you to earn interest and borrow money with crypto assets as collateral. The platform provides quick loans and interest accounts in Litecoin and Bitcoin. It works in this manner: you send your crypto assets and receive dollars to your bank account. Each loan is determined by the loan-to-value ratio. This determines the collateral value. BlockFi will grant you a loan of up to $1000 if you have 0.05 bitcoins.

To get a loan from this platform, you will need to verify your identity. The platform offers a crypto interest account, which earns interest on a daily basis. The crypto used to secure your loan doesn’t earn interest. Crypto loans are typically for 12 months. You can also make early payments. Although the interest rate for cryptocurrency loans starts at 4.5%, it can vary depending on the loan-to-value ratio. Deposits earn interest rates of 8.6% per year using the Interest Account.

In February 2021, BlockFi paid more than $35 million in interest for its clients. The interest payments consisted of 450 bitcoin (BTC), 5,000 Ether(ETH) and $6,000,000 in stablecoins.

SALT Lending Crypto Loans

SALT Lending was established in 2016 in the US. SALT Lending offers individual and business crypto-backed loans. After your crypto loan approval is granted, you will receive cash, USDC, or TUSD directly to your account. There are no additional fees. It is available in 46 US states, Canada and the United Kingdom.

You don’t have to sell your cryptocurrency if you don’t have the money. You can use your cryptocurrencies as collateral to obtain a loan through SALT Lending. SALT Lending allows you to obtain a cash loan of $5,000 for three to twelve months. You can also secure the loan using stablecoin. The maximum loan amount is dependent on the country and any other restrictions. The platform does not require you to have good credit to be eligible for an instant cryptocurrency loan. Instead, it will consider your reputation. The loan can be repaid in monthly installments.

The SALT credit card allows you to HODL cryptocurrency and spend cash. Earn crypto rewards for every purchase you make with your SALT Card.

StackWise, a new product from SALT, allows you to receive a portion of your monthly payments back to your wallet as crypto rewards. You can get rewards in Bitcoin, Ether or USD Coin. You can stack crypto rewards to lower your loan-to value ratio (LTV), minimize Stabilization risk, or withdraw your crypto rewards.

Octabis Crypto Loans

Octabis, a cryptocurrency lending platform, offers instant bitcoin loans without credit checks. These platforms allow users to borrow money with bitcoin collateral and keep the bitcoin value. Instant crypto-backed loans are available without the need to sign any documents or pass credit checks. It’s quick and easy to apply online. Octabis allows you to borrow as little as 20 EUR and as much up to 100,000 EUR. The current monthly interest rate for Octabis is 1%. This means that you only pay 12% annually.

Octabis also offers a blockchain solution to help businesses start their own crypto lending company by integrating Octabis API and Octabis widget onto their websites.

An anonymous Bitcoin loan is possible: CoinRabbit, Guarda and other platforms offer anonymous crypto loans that are completely anonymous and private.

Binance Crypto Loans

Binance is the largest cryptocurrency exchange platform. It supports crypto lending to customers with crypto deposits. To get a crypto loan or fiat cash loan, you can use crypto as collateral. BTC, USDT and BUSB are all supported cryptos. EUR and GBP support fiat currencies.

The loan term can vary. There are loan terms for Binance of 7, 14, 30 and 90 days. You will need to pledge 0.05363077 Bitcoin to secure a loan of 1000 EUR. You will have to repay 1023.4 EUR if your loan term is 90 days. You can repay the loan in advance, and interest is calculated according to the number of days borrowed. The loan matures in two weeks. The annual interest rate for Tether Classic, Binance Coin, and Tether is between 10, 15, and 7 percent.

Celsius Network

Celsius Network platform was launched in July 2018. The platform offers loans for which borrowers can use crypto collateral. The APR on their loans starts at 1%. They offer a minimum loan of $500 and a security of equal value. CelPay is used by Celsius, which allows for free transfers of cryptocurrency from one wallet into another. To borrow $1000 on the platform, you will need to deposit 0.1154 Bitcoin in collateral. The total interest you will pay for 6 months is $5.

The platform has accumulated more than $1 billion in crypto deposits over the past two years. It has also issued interest of over $17million to depositors. Customers can earn interest on their deposits by transferring their crypto assets to their Celsius wallet. This is a great platform to invest and earn interest.

Unchained Capital

Unchained Capital is a platform that offers private instant cryptocurrency-backed Loans (USA) and commercial crypto backed loans in the US and some countries around the world. There are different requirements for minimum sizes, interest rates and other details depending on the state.

Unchained Capital can lend in certain foreign countries but our lending capabilities outside the USA are limited. Please email us at [email protected] if you are outside the United States with information about your loan request. We will only lend to you if it is for a commercial purpose. The minimum loan amount must be $100k USD.

Bitcoin P2P Lending Platforms

P2P lending is a platform that connects borrowers and lenders of Bitcoin. These are safe and secure ways to invest in Bitcoin, as well as to obtain a p2p Bitcoin Loan. LendaBit and BTCPOP are some of the crypto p2p lending platforms.

Get P2P Crypto Loans from Lend at Hodll

Lend at Hodl Hodl Hodl At Hodl Hodl is an p2p, bitcoin-backed lending product from Hodl Hodl. It’s a Bitcoin exchange. You can use Bitcoin or Liquid Bitcoin to borrow USDC, PAX and USDT.

Based on the length of the contract, the origination fee for Lend at Hodl Hodl is between 0.5% and 1.5% of the loan amount. The borrower pays Hodl Hodl fees. Lend at Hodl Hodl pays a 2% commission. After the Contract is in force, a commission will be automatically charged. Based on the length of the loan, origination fees will be charged as follows: 1 day: 0.5%; 1 week – 5 months: 1%; 6 months – 12 months: 1.5%

LendaBit Cryptocurrency P2P Lending

LendaBit, a cloud mining platform, now offers cryptocurrency p2p loan. LendaBit connects borrowers and lenders who submit Loan Requests or Loan Offers. They can specify the terms they prefer, such as interest rate, repayment term, and loan amount. Crypto collateral is used to secure all crypto p2p loans. A 1% service fee is charged to the borrower from the loan amount. You can use your crypto assets (BTC, ETH, USDT (OMNI), etc.) as collateral. The minimum loan term is one day, while the maximum is three years.

BitBond

BitBond has stopped offering loans and their Bitcoin lending service. B2B Digital Asset Tech solutions are now offered by the company.

Bitbond, a Berlin-based platform for p2p Bitcoin lending, is called Bitbond. Its services can be used worldwide. Lenders earn interest while businesses can borrow money. The reputation system determines who is eligible to receive loan offers. You must meet the minimum investment requirements to be eligible for a loan. These investments are best suited to small businesses because they offer high returns. They have a high interest rate, while loans are based on national currencies. This can lead to lenders losing money if Bitcoin prices rise. Bitbond loans can also be funded in bitcoins or fiat currencies such as USD, EUR, and Kenyan shillings through BitBond partnership.

Small online businesses love Bitbond. Bitbond reviews small business loan applications by looking at connected accounts on platforms like Amazon, eBay, and Paypal.

BTCPOP Review

BTCPOP, a UK-based p2p platform, offers peer-to-peer Bitcoin loans. The platform gives Bitcoin loans based on reputation, not financial history or credit score. Lenders can give loans to borrowers and you can get a loan. You can get a loan from lenders for as little as 0.01 up to 500 Bitcoin loans. It offers Bitcoin personal loans and Bitcoin business loans.

You will need to create an account with a username, email, password, and email address in order to be eligible for the crypto loan. Next, verify your identity by providing your address, verification SMS and links to social media accounts. Finally, you will need to establish your reputation with BTCPOP.

How to build a reputation with BTCPOP

It is difficult to build a good reputation for Bitcoin transactions. You can do a few things to build your reputation. These steps do not guarantee that you will be approved for a loan. You will be able to get a loan based on what the market is telling you.

Collateral is a good idea. Collateral loans are a great way to make a good impression. Then, you must fully repay the loan. Altcoins and shares are two examples of securities that you can use to repay the loan. Altcoins can be exchanged at BTCPOP. You can also use shares that are listed on a platform. These shares can be used to secure a loan by being traded at a price that is marketable.

If you are a well-respected platform, you can share the information with BTCPOP. Send them screenshots, PDFs and loan listings. You should make sure that your proof is tangible.

You can help build your reputation by referring a person who uses BTCPOP. Your reputation can be built by being active in your community. Your loan approval will be quicker if your peers view you positively. Lenders are interested in how borrowers are perceived by lenders. You can participate in the community by creating a profile with a bio, profile photo, and links. Next, make sure you interact with the forums and chat.

Are you struggling to get your business off the ground? BTCPOP allows users to launch an IPO (initial public offer). Everybody deserves the chance. If you believe you have a great idea for a business, but don’t have enough funds, creating an IPO through BTCPOP gives other users the chance to invest in it. This increases your chances of making your dream business a reality.

When is the Best Time to Get Your First Bitcoin Loan With BTCPOP?

You have two options to get a loan. Instant collateral loans and instant instant instant instant loans are the first. When you are looking to acquire a Bitcoin loan, this is the best loan. You will be able to establish your reputation and work with them easily. A good reputation will help you get competitive rates for your next loan. Although the loan amount is typically small, you can increase it by adding collateral. To build your reputation, make sure you pay off the loan on time. The loan process is costly because it is very expensive.

You can also borrow custom loans. Before submitting your request, fill in all required information online.

Paying Bitcoin Loans with BTCPOP

It is crucial to pay your loan on time. Your reputation will be damaged if you fail to pay the loan on time. Go to the PAYMENTS OUT tab on your account to access your loan. Pay attention to the following:

You should have enough money at least three days in advance of the due date. It is possible for Bitcoin blockchain to be delayed. Therefore, it is important that you have funds in advance.

If you are in an emergency situation and suspect that you might not be able to pay the loan on time, notify the lender immediately. This can help you project a positive image even if you are in a difficult financial situation. You should make sure you pay less than nothing.

Why P2P Bitcoin loans over banks?

These are the benefits of peer-to-peer Bitcoin loans over bank loans if you’re unsure whether to get a loan.

Lenders don’t have to pay any fees, while borrowers must pay between 1% and 5%.

They can approve loans faster than banks, which are slow and bureaucratic and take a long time to approve loans.

Scams are less likely since Bitcoin lenders approve individual loan applications manually. They conduct manual checks which reduces the chance of fraud.

Customers get a financial benefit from it. Lenders can get a higher return on their investment because rates vary between 3 to 7 percent per month.

For a Bitcoin Loan, you will need to provide documentation

These documents may be required when you apply for a Bitcoin loan.

Government Identity card

Verification of credit card. Verify that you are paying your credit cards on time.

Verification of social media accounts. Social media accounts are used by lenders to verify that you have friends and engage in some activities. Make sure that your accounts are all active.

You can also use online bank accounts like PayPal or TransferWise Borderless to show that you have paid your debts on-time.

Utility bills, such as electricity and apartment leases, are included.

An income verification is essential as no lender will lend you money if you don’t have one.

Email verification

Cryptocurrency Exchanges Offer Instant Loans

Kraken and Bitfinex allow you to trade margin, which is essentially a short-term loan. Although there are risks, it is worth considering.

Social Media Accounts that You Can Use to Get Bitcoin Loans

Verification can be done on Linkedin, Twitter and Facebook.

Continue reading